Current office hours can be viewed on the Cashiers Office About Us page

Phone 816-235-1365

Fax 816 235 5510

Email cashiers@umkc.edu

Mailing Address:

Physical Address:

All Cashiers Office policies are based upon the University of Missouri's Statement of Financial Responsibility. All students enrolling in classes after March 28th, 2008 are subject to the terms of the University of Missouri's Statement of Financial Responsibility. You can review a copy of the statement here:

Statement of Financial Responsibility

Please Note:

Students who need to direct payments to specific charges or balances must make their payment in person or contact the Cashiers Office after making an online payment. All payments — other than financial aid disbursements — will be automatically applied to the oldest balance unless otherwise requested.

You may make payments using your bank account's routing and account information, credit card or debit card through Pathway and navigating to TouchNet.

Learn more about paying through Pathway (PDF)

Authorized users may pay using their bank account's routing and account information, credit card or debit card through their authorized user account.

Add an authorized user to your account (PDF)

Those without an authorized user account may pay with a credit card as a guest payer.

Checks are processed using the routing and account information and are accessible only by you or your authorized user. Credit and debit card payments are processed by a third party, which collects a service charge for each transaction and are not refundable. The charge amount may not exceed the amount due.

Please note that e-check and credit or debit card payments cannot be canceled by the university once they are submitted. Please make sure the amount is correct and you are using the correct account info before submitting the payment. Credit and debit card transaction fees are not refundable. If the e-check returns for any reason, a $25.00 returned check fee will apply to the student account. Any credit or debit card transaction that is disputed, stopped or returned for any reason will also have a $25.00 returned fee assessed.

You may also pay your bill online through direct debit of your checking or savings account. Payments made with your online banking service may result in a significant delay in the processing. We make no guarantees that your payment can be received and processed by the due date.

Effective October 1, 2021, the United States Postal Service (USPS) has revised its service standards for certain First-Class Mail items, resulting in possible longer delivery times depending on distance. Please note that this may delay your receipt of mail from us and our receipt of mail from you (including mailed payments). Please take this change into account when mailing items to us via USPS. For more information, visit usps.com.

If you haven't already, consider online payment options available through TouchNet or Guest Pay.

You may make your payments by sending us a personal check, bank-certified or cashier's check or money order through the U.S. Postal Service. Do not send cash through the mail.

Please include your student ID number with payment.

UMKC accepts cash, personal checks, money orders and bank-certified and cashier's checks Monday - Friday 8am to 4:30pm. Go to UMKC Central in Room 120 at the Administration Center at the address below to check in.

5115 Oak St.

Kansas City, MO 64112

There is an ATM in the Administration Center for your convenience.

Financial aid and scholarships that have been approved but have not yet paid to the student account are considered to be "anticipated". Anticipated aid is deducted from the current term balance in the billed balance calculation area of your monthly billing statement. The balance remaining will be billed to the student and the minimum payment must be paid by the due date to avoid having classes canceled. The remaining balance will also be subject to the 1 percent monthly finance charge. When the aid is received, it will be applied to the student account but there will be no reduction in the amount due since the aid was already taken into consideration and deducted from the current term balance. Current term aid should not be used to pay past aid year balances.

If financial aid is sufficient to cover all fees on a student account, payment for the excess aid will be processed. If you have direct deposit, the processing time is two to four business days to transfer the funds into your personal savings or checking account. If your banking information changes or if you wish to cancel your direct deposit, please update it online at Pathway. Any refunds scheduled for direct deposit will go directly into the bank account set up by the student; they cannot be canceled by our office, so please make sure to update your information on Pathway. Direct deposit information remains activated from the time it is set until it is canceled by the student. For more information on setting up direct deposit, Download PDF instructions.

If you do not have direct deposit, we will mail a check. Checks are mailed once a week on Tuesdays and you can expect the check within 2 weeks of mailing. Checks do NOT come to the Cashiers Office; they are mailed out directly from Columbia, MO to the local address on file for the student in Pathway.

The Financial Aid and Scholarships Office BEGINS disbursement onto student accounts the week before classes begin. You can view your financial status online at Pathway by clicking on "Campus Finances", then "Account Inquiry" followed by the "Activity Tab". Financial aid disbursements and refunds will show on this tab.

If you are utilizing a 529 college savings plan, your provider will mail us a check. You will need to provide them the balance to pay along with your name and student ID number so that we can post it to your account. Checks should be made out to UMKC.

The mailing address for them to send the check is:

Please allow them sufficient time to process and mail the check to us so we can receive it prior to the due date to avoid late fees and finance charges from assessing to your account.

Some 529 college savings plans may allow you to pay by electronic payment. Please check with your plan representative to see if they offer this option and for instructions. The payment processor for your 529 plan may charge a fee for this service. UMKC does not receive any portion of that fee and we cannot waive or refund it. In order for the payment to post properly, you will need to include your 8 digit student ID number when the 529 electronic payment is submitted.

If the Cashiers Office has valid approval from the third-party sponsor prior to the student registering for classes, the sponsor credit show on the student's account once they have selected classes.

If the credit is not showing, please contact Sponsor Billing.

Telephone 816-235-1365

Third-party sponsorship is not tuition reimbursement. If your employer or sponsor will delay payment until after grades are available, or will not pay if a certain grade is not obtained, then they will not be accepted as a third-party sponsor.

If you do not have full sponsorship for all your fees, you must make the minimum payment in order to hold your classes. All unpaid balances are assessed a 1% monthly finance charge. If you owe a past term balance, it must be paid in full.

If a foreign government embassy or government or state agency pays part or all of the student’s educational expenses, the student can elect to have them billed through the university’s sponsor billing process. The university will also extend this process to some, but not all, private employers. Please contact the Cashiers Office to find out if your employer is an existing third-party sponsor.

Send direct written authorization from the student’s sponsor to this address.

Upon receipt of a completed billing authorization, a credit will be posted to the student’s fee account for the amount authorized. The university will bill the sponsor directly on the student’s behalf. If the sponsor does not pay in a timely manner (typically within two weeks of the end of the current semester), the third-party credit will be removed from the student’s account and the student will be responsible for payment.

If the student does not have full sponsorship for the entire amount of their fees, or if their employer is not an existing third-party sponsor, they must make at least the minimum monthly payment in order to keep from being dropped from classes. This balance may include additional charges at the Swinney Center, UMKC Bookstore, Parking Office, One Card Office or Roo Wellness Center.

If the student pays less than the full billed balance, they will be subject to a 1% monthly finance charge on the unpaid billed balance. If a student owes a past term balance, it must be paid in full before being able to enroll in future semesters. Failure to turn in third-party authorizations in a timely manner may result in fees that the student remains responsible for paying. Third-party authorizations for terms that have ended will not be processed. UMKC reserves the right to decline to allow for third-party billing for any student or sponsor. Reasons for this decline may include grade-based sponsorships, sponsorship contingent upon employment or previous issues with payment by the student or sponsor.

The Cashiers Office waives any late fees or finance charges that assess on balances paid by Ch33 or Ch31 benefit recipients when the payment from U.S. Dept of Veterans Affairs (VA) is received. Any late fees or finance charges that accrue on balances not covered by VA benefits will be the student’s responsibility to pay.

Students will be able to attend classes and utilize campus facilities while the VA works to disburse funds to UMKC for a given term. Ch33 or Ch31 benefit recipients are exempt from being dropped for non-payment while the VA works on disbursing funds to UMKC.

Ch33 or Ch31 students are free to take out loans if they so wish but it is not required. Any refundable excess from student financial aid will be refunded when payment from the VA is received and there is an overage on the student account.

Return of Tuition Assistance: Military Tuition Assistance (TA) is awarded to a student under the assumption that the student will attend school for the entire period for which the assistance is awarded. When a student withdraws, the student may no longer be eligible for the full amount of TA funds originally awarded.

To comply with the new Department of Defense policy, the University of Missouri-Kansas City will return any unearned TA funds on a prorated basis through at least the 60% portion of the period for which the funds were provided. TA funds are earned proportionally during an enrollment period, with unearned funds returned based upon when a student stops attending. These funds are returned to the military Service branch. When a Service member stops attending due to a military service obligation, the educational institution will work with the affected Service member to identify solutions that will not result in student debt for the returned portion.

Tuition reimbursement is not the same thing as third-party sponsorship as discussed above. If a student is eligible for tuition reimbursement though their employer or other 3rd party it is still the student’s responsibility to pay their balance. Payments can be made either in full at the beginning of the semester or according to the semester payment schedule as you are invoiced each month. Students with tuition reimbursement are not exempt from the regular repayment schedule or the assessment of finance charges and late fees, or enrollment and transcript holds. Reimbursement programs are set up to directly repay the student what they have actually paid the University. Reimbursement programs do not typically cover finance charges, late fees, or other non-educational fees/expenses. The determination of what is and isn’t eligible for reimbursement is up to the organization. It is the student’s responsibility to confirm what is and isn’t covered.

Please remember that if the reimbursement program is dependent on final grades or completion of class, official and/or unofficial transcripts cannot be released to the student until the outstanding balance due is paid in full.

If you need documentation for tuition and fees paid for your reimbursement program you should reference either your monthly invoices in TouchNet or a paid fees letter in Pathway. You have access to an itemized summary of your charges and credits for each semester through the Pathway system. The paid fees letter will also show the classes and number of credits you are enrolled in. Log-in to the student Pathway. On the left-hand menu, click “Self-Service” then “Campus Finances” then “Paid Fees Letter”. From there you can select the term you desire information on and it will provide you with the Official Receipt/Paid Fees Letter. If the monthly billing statements and/or paid fees letter are not sufficient for your reimbursement program, please contact our office and we will do our best to accommodate your needs.

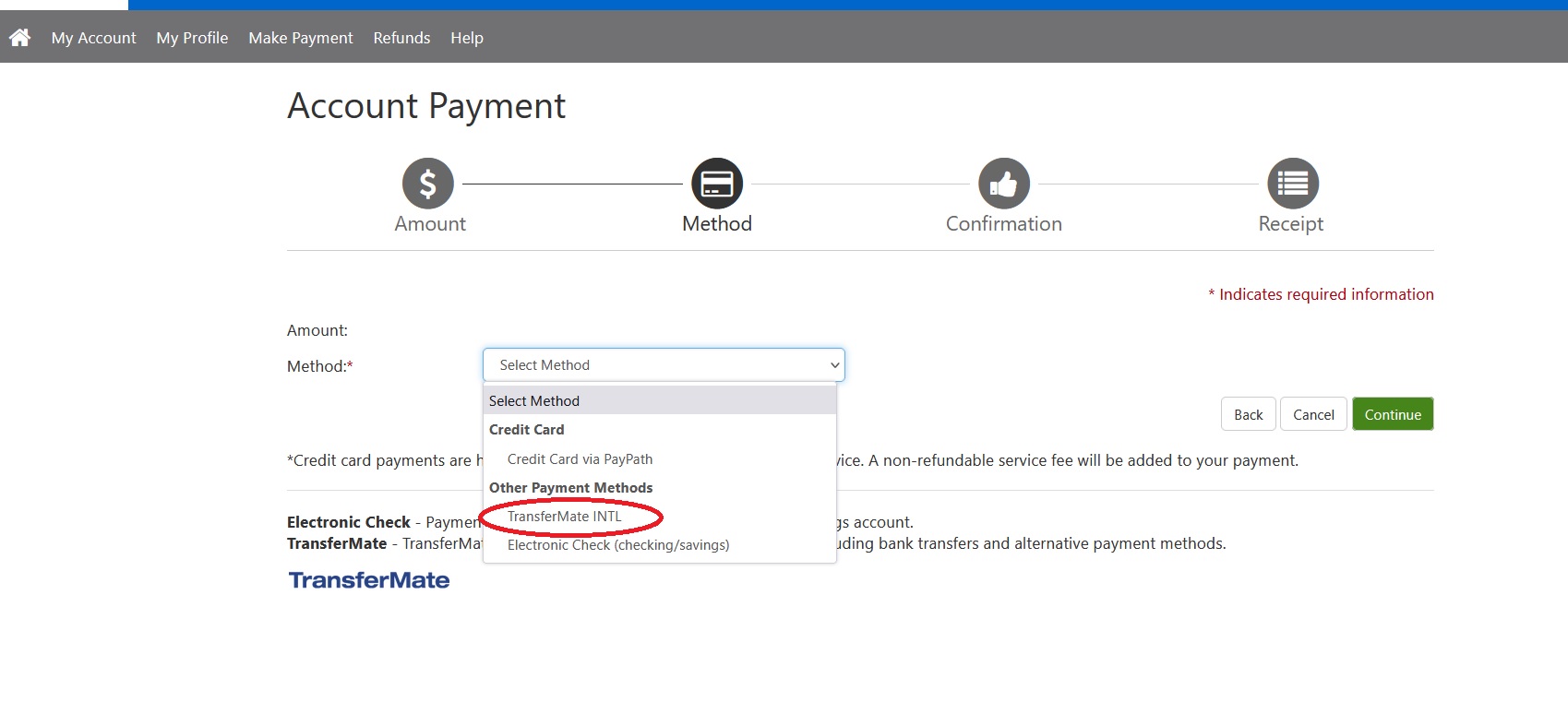

UMKC has partnered with TransferMate to streamline the tuition payment process for our international students.

Now you can make your international payments in your own local currency and to a local bank account directly in Touchnet.

When you are ready to pay in TouchNet, under Select Method, click on TransferMate and click Continue.

Click on the following link for details about TransferMate:

https://universityofmissourikansascity.transfermateeducation.com/

Click on the following link for instructions on how to pay in TouchNet:

https://www.umkc.edu/cashiers/docs/make-a-payment.pdf

Click on the following link for other ways you can pay:

https://www.umkc.edu/cashiers/payments-and-billing/payment-methods.html

If you opt to send a traditional wire transfer you’ll need the following info:

Commerce Bank

720 Main St, Kansas City MO 64105

Account Name: CURATORS OF THE UNIVERSITY OF MISSOURI

Routing # 101000019

Swift Code CBKCUS44

Account 400168394

Once you send the traditional wire transfer you need to send an email to cashiers@umkc.edu with the following info:

Your full name/senders name

Your 8 digit UMKC ID #

The date of transfer

The amount of transfer in US Dollars

The bank that originated the transfer

Any tracking or confirmation # associated with the transfer.

PLEASE NOTE: Sending by wire transfer does not mean that the funds will post to your student account immediately. The process may take a few days. You will receive an email when your traditional wire transfer payment has been posted to your account.

ADDITIONAL IMPORTANT INFORMATION ABOUT PAYMENT

DUE DATE/MINIMUM PAYMENT

If you do not pay your balance in full by the first due date of the semester you automatically default into the standard current semester payment plan. Refer to your monthly invoice for the monthly minimum payment each month. If you fail to make the minimum invoiced payment or any of your aid is reduced your minimum payment will default to the total amount due on the next invoice.

The first payment of the semester is 25% of your outstanding balance less any aid, scholarship, or fee waivers that have been applied. This payment is due even if you enroll after the first invoice of the semester is prepared.

Please remember any unpaid balance you carry from one invoice to the next is subject to a 1% monthly finance charge. You should pay as much as possible as early as possible to reduce the overall dollar amount of the finance charge. A $25.00 late fee is assessed each month that a partial payment isn’t received. The only way to avoid the 1% monthly finance charge is to pay your balance in full, not the minimum payment.

Your minimum payment will not always be 25% of your balance. The 25% each due date works if, and only if,

In most cases you can override the default amount in TouchNet to pay any amount if you are paying online. If you have anticipated aid that you are not going to accept you may need to log into Pathway and decline that aid in order to pay the total due in TouchNet.

Current UMKC employees can request payroll deduction on their UMKC account balance by sending an email from their UMKC account to cashiers@umkc.edu. The subject line of the email needs to be "Employee Request to Start Payroll Deduction." In the body of the email include the following information:

You will receive a confirmation email once your request has been processed.

IMPORTANT NOTES REGARDING PAYROLL DEDUCTION

Current UMKC employees can request payroll deduction on their UMKC account balance by sending an email from their UMKC account to cashiers@umkc.edu. The subject line of the email needs to be "Employee Request to Start Payroll Deduction." In the body of the email include the following information:

You will receive a confirmation email once your request has been processed.

IMPORTANT NOTES REGARDING PAYROLL DEDUCTION

Educational debts are not typically dischargeable through bankruptcy and will survive after the bankruptcy has been dismissed or discharged. The following is a general outline of the bankruptcy filing process as it pertains to outstanding debts owed to and enrollment and registration at UMKC.

The student, the student’s legal representative or the bankruptcy court must provide written documentation of the bankruptcy filing, including chapter, case number, filing date and legal representative contact number.

Once notice of bankruptcy filing is received all formal collection efforts for the balance incurred prior to the bankruptcy filing will cease, pending the decision of the court. While the bankruptcy case is open and active the Cashiers Office will cease sending a monthly invoice and stop the assessment of additional finance charges and late fees. These actions will resume once the Cashiers Office receives notification that the bankruptcy case is closed. Students who enroll in classes after a bankruptcy filing will still be subject to the assessment of finance charges and late fees.

Students with an active bankruptcy on any UMKC debt or who have had UMKC debt discharged through bankruptcy are still eligible to enroll and register at UMKC. However, no additional credit will be extended to students with an active bankruptcy filing. Students with an active bankruptcy filing are required to pay in full for any class they register for by close of business on the same day they register.

Students with an active bankruptcy filing cannot use their student account charging privileges at the UMKC Bookstore, Swinney Center, Parking Office or One Card program. Students with an active bankruptcy are also not eligible for any kind of short-term loan, either cash or credit, from any other university office.

Students with a past due balance included in a current bankruptcy filing will automatically have an enrollment hold on their account. It is the student’s responsibility to contact the Cashiers Office on the day they are prepared to enroll and pay the resulting balance to have the enrollment hold lifted.

Students with an active or previously discharged bankruptcy that included a UMKC balance and who intend to use pending financial aid or other non-cash means to pay their balance will not be allowed to enroll until the Cashiers Office has verification of the anticipated aid. This anticipated aid must be verified by a representative of the Financial Aid and Scholarships Office or showing as anticipated aid on the student’s account in Pathway. The student has until the first due date of the semester for the aid to disburse and pay the balance in full. If the balance is not paid in full by the close of business on the first due date of the month the student may be manually dropped from any classes they registered for.

Students are not guaranteed re-enrollment into any class that may have filled between the drop and the time it takes to re-register. Any fees added after the semester’s aid disbursement are due in full within 48 hours of the fees being applied.

Students with an active or previously discharged bankruptcy that included a UMKC balance and who are paying with personal funds (cash, check, credit card) must pay their account balance in full within 48 hours of the fees being applied. Students who fail to make the required payment by the close of business will be manually dropped from any classes they registered for. Students are not guaranteed re-enrollment into any class that may have filled between the drop and the time it takes to re-register.

The student, the student’s legal representative, or the bankruptcy court needs to provide written documentation of any debt legally discharged through bankruptcy. This documentation is subject to verification by UMKC legal counsel prior to writing off the debt or releasing transcript or other records.

The Cashiers Office cannot provide legal advice. Students with questions regarding their outstanding balance during or after a bankruptcy filing should refer those questions to their legal representative to be answered by the University of Missouri System’s general counsel.

If you register for classes on or after the first billing date for the semester, you will not receive a billing statement before the first payment for the semester is due. Please make the initial payment on Pathway by the due date for the semester.

The payment schedule is determined by dividing the current semester's charges by the number of installments remaining in the semester. Any past term balance or previous unpaid minimum is due in full.

The University does not require payment in full at enrollment. However, students are required to make monthly payments toward their outstanding balance over the course of the semester. Balances, which include tuition, ancillary fees, parking violations, bookstore charges, financial aid adjustments, rent/housing fees and other miscellaneous charges, need to be paid in full by the end of that semester.

Our system does not recognize double payments or paying ahead. Payment must be made between the billing date and the due date showing on the statement to be current and avoid the late fee. If you decide to “prepay” before you are billed for the payment, your account will still be assessed the monthly late fee if another payment is not received before the actual due date for the payment.

The University assesses a 1 percent monthly finance charge on the unpaid portion of the total billed balance. You can avoid the finance charge by paying the total balance each month. If you choose to pay the minimum payment amounts listed on your bill, you will be charged a one percent monthly finance charge. A late fee will assess if payment is not made by the due date.

Payment in full is due by the first due date of each semester. If the student cannot pay the balance in full the University will accept partial payments according to the schedule below.

| Due date | Amount of balance due |

|---|---|

| August 10 | 25% |

| September 10 | 50% |

| October 10 | 75% |

| November 10 | Remaining Balance |

| Due date | Amount of balance due |

|---|---|

| September 10 | 33% |

| October 10 | 66% |

| November 10 | Remaining Balance |

| Due date | Amount of balance due |

|---|---|

| October 10 | 50% |

| November 10 | Remaining Balance |

| *Please note that a payment may be required in September to avoid drop for non payment. | |

| Due date | Amount of balance due |

|---|---|

| January 10 | 25% |

| February 10 | 50% |

| March 10 | 75% |

| April 10 | Remaining Balance |

| Due date | Amount of balance due |

|---|---|

| February 10 | 33% |

| March 10 | 66% |

| April 10 | Remaining Balance |

| Due date | Amount of balance due |

|---|---|

| March 10 | 50% |

| April 10 | Remaining Balance |

| *Please note that a payment may be required in February to avoid drop for non payment. | |

| Due date | Amount of balance due |

|---|---|

| June 10 | 50% |

| July 10 | Remaining Balance |

| Due date | Amount of balance due |

|---|---|

| June 10 | 50% |

| July 10 | Remaining Balance |

| Due date | Amount of balance due |

|---|---|

| July 10 | Remaining Balance |

University Policy does not allow transcripts to be released directly to students on any account with a balance. The Cashiers Office may make exceptions for students carrying a balance under the following guidelines for the purposes of 1) obtaining a 3rd party scholarship or sponsorship to pay an existing UMKC account balance, 2) applying to graduate school, 3) Employment, Internship, or Professional Licensing opportunities, or 4) grade based discounts from insurance companies. If an exception is granted that transcript will be sent directly to the appropriate 3rd party. Under no circumstances will the transcript be released directly to the student.

These exceptions are made on a case by case basis. Not all students will qualify for an exception. Reasons for withholding the transcript exceptions include, but are not limited to: large account balances, returned/stopped checks, suspected fraud, suspension or expulsion from the University, history of repayment agreement defaults, disputing or petitioning existing balance or a lack of consistent payment history (a consistent payment history is defined as making at least the minimum invoiced amount each month by the 10th). Also, current or former students who request transcripts in order to enroll in different undergraduate institution must have their balance paid in full before a transcript is released.

If you meet the criteria for “recent graduate” or “currently enrolled student” as defined above send an email to cashiers@umkc.edu with the subject line “Transcript Request Exception” along with the decline email you received when you ordered your transcript. In the body of the email please provide the answers to the appropriate set of verification questions below::

3rd party scholarship or sponsorship to pay a UMKC balance

Graduate school admission

Employment/Internship/Professional Licensing Purposes/Fraternities & Sororities

Grade Based Discounts

Transcript exception for employment/licensing purposes FOR BALANCES MORE THAN 3 YEARS OLD (effective 6/15/2022)

For outstanding accounts receivable balances that are more than 3 years old, the Cashiers Office will authorize an exception transcript release for employment and/or employment licensing purposes.

The transcript will not be released to the student directly, but only to the employer/licensing organization. The payment must be made with guaranteed funds (cash, certified check, or credit card). If the account is actively assigned to a 3rd party collection agency the payment must be made with to the 3rd party collection agency.

The exception guidelines are granted at the discretion of the Cashiers Office and will automatically exclude the following students:

The Cashiers Office exceptions are only related to financial issues related to unpaid accounts receivable balances. Transcript holds from any other offices must be resolved separately and according to the requirements of that office.

IMPORTANT NOTES REGARDING TRANSCRIPT REQUESTS & EXCEPTIONS

Payment in full of any and all outstanding balances, is required for diploma release. If a student has earned a diploma/certificate in an undergraduate/graduate/professional program, we will make an exception for future tuition and fees if they are enrolled in another undergraduate/graduate/professional program at UMKC and payment for that term isn’t due yet. Once the term of that undergraduate/graduate/professional program has started that balance would need to be paid in full before the diploma will be released. Charges such as parking tickets, housing damages, bookstore charges, or other misc. fees not associated with future enrollment must be paid in full regardless of what term they have been applied to.

IMPORTANT NOTES REGARDING DIPLOMA REQUESTS

The university allows enrolled students to charge their student accounts for goods and services at the UMKC Bookstore, Swinney Center, Parking Office, One Card Office and Roo Wellness Center. Students are expected to pay their accumulated balance each month; however, there may be a delay in posting charges from these offices to the student account.

Students who want to pay specific charges must make their payment with a cashier and specify what charge they want paid. Any balance assessed to a student account from these offices is subject to finance charges and late fees.

Students are strongly encouraged to regularly review their account balances on Pathway. It is the student’s responsibility to follow up on any disputed or misapplied charge with that respective office. The Cashiers Office cannot waive or adjust the charges unless directed to do so by the office that originated the charge.

The Cashiers Office may suspend charging privileges (except at the Roo Wellness Center) for these reasons.

Students who start a computer purchase installment contract with the bookstore must maintain active enrollment. Students who withdraw from classes, graduate or transfer to another university may have their payment schedule escalated and all unbilled installments applied to their account at the request of the Cashiers Office.

The Cashiers Office may withhold charging privileges to a student with an unpaid balance in default with another University System Campus (Columbia, Rolla or Saint Louis).

A $25 late fee will be added to your student account if a payment is not received by the monthly billing statement's due date.

If you are past due you may also be subject to holds, including enrollment holds, transcript and diploma holds, loss of student charge privileges and denial of access to the Swinney Center.

The University assesses a 1% monthly finance charge on the unpaid portion of the total billed balance. You can avoid the finance charge by paying the total balance each month.

UMKC e-mail is the official University method of communication with the student. It is the student's responsibility to check and responsibly manage their UMKC email account so that important information can be received. Billing statements are updated monthly. Students are notified via their UMKC email address when the monthly billing statement is available for viewing. The email ls not the actual statement; It Is only a notification of the statement. The actual electronic billing statements can be viewed from Pathway.

As billing statements are available online, failure to receive a billing statement does not constitute a valid reason for not paying a bill by the specified due date. Students are responsible for any actions or fees that result from failure to pay charges on the specified due date.

Pursuant to UMKC Information Services policy, UMKC student email accounts will be deactivated by Information Services within the specified period of time after the end of the last term enrolled. It is strongly encouraged that students add an alternate email address they will always have access to so that statement notifications can be received after separation from the University.

Current and former students can also access Pathway for up to date account information. You may need to reset your Pathway password if it has been while since you logged in to Pathway. Students may request mailed paper statements by contacting the Cashiers Office. Students who leave the University with a balance will have paper statements sent to them at the address on file with the Cashiers Office, in addition to email statements at their UMKC email address (until such time that the UMKC email address becomes inactive) and alternate email address that is on the student account.

It is the student's responsibility to keep the Cashiers Office updated with their most current address and contact information. Find out how you can change your contact information at https://www.umkc.edu/registrar/docs/information_change.pdf

If the Cashiers Office has valid approval from the third-party sponsor prior to the student registering for classes, the sponsor credit show on the student's account once they have selected classes.

If the credit is not showing, please contact Sponsor Billing.

Telephone 816-235-1365

Third-party sponsorship is not tuition reimbursement. If your employer or sponsor will delay payment until after grades are available, or will not pay if a certain grade is not obtained, then they will not be accepted as a third-party sponsor.

If you do not have full sponsorship for all your fees, you must make the minimum payment in order to hold your classes. All unpaid balances are assessed a 1% monthly finance charge. If you owe a past term balance, it must be paid in full.

If a foreign government embassy or government or state agency pays part or all of the student’s educational expenses, the student can elect to have them billed through the university’s sponsor billing process. The university will also extend this process to some, but not all, private employers. Please contact the Cashiers Office to find out if your employer is an existing third-party sponsor.

Send direct written authorization from the student’s sponsor to this address.

Upon receipt of a completed billing authorization, a credit will be posted to the student’s fee account for the amount authorized. The university will bill the sponsor directly on the student’s behalf. If the sponsor does not pay in a timely manner (typically within two weeks of the end of the current semester), the third-party credit will be removed from the student’s account and the student will be responsible for payment.

If the student does not have full sponsorship for the entire amount of their fees, or if their employer is not an existing third-party sponsor, they must make at least the minimum monthly payment in order to keep from being dropped from classes. This balance may include additional charges at the Swinney Center, UMKC Bookstore, Parking Office, One Card Office or Roo Wellness Center.

If the student pays less than the full billed balance, they will be subject to a 1% monthly finance charge on the unpaid billed balance. If a student owes a past term balance, it must be paid in full before being able to enroll in future semesters. Failure to turn in third-party authorizations in a timely manner may result in fees that the student remains responsible for paying. Third-party authorizations for terms that have ended will not be processed. UMKC reserves the right to decline to allow for third-party billing for any student or sponsor. Reasons for this decline may include grade-based sponsorships, sponsorship contingent upon employment or previous issues with payment by the student or sponsor.

The Cashiers Office waives any late fees or finance charges that assess on balances paid by Ch33 or Ch31 benefit recipients when the payment from U.S. Dept of Veterans Affairs (VA) is received. Any late fees or finance charges that accrue on balances not covered by VA benefits will be the student’s responsibility to pay.

Students will be able to attend classes and utilize campus facilities while the VA works to disburse funds to UMKC for a given term. Ch33 or Ch31 benefit recipients are exempt from being dropped for non-payment while the VA works on disbursing funds to UMKC.

Ch33 or Ch31 students are free to take out loans if they so wish but it is not required. Any refundable excess from student financial aid will be refunded when payment from the VA is received and there is an overage on the student account.

Return of Tuition Assistance: Military Tuition Assistance (TA) is awarded to a student under the assumption that the student will attend school for the entire period for which the assistance is awarded. When a student withdraws, the student may no longer be eligible for the full amount of TA funds originally awarded.

To comply with the new Department of Defense policy, the University of Missouri-Kansas City will return any unearned TA funds on a prorated basis through at least the 60% portion of the period for which the funds were provided. TA funds are earned proportionally during an enrollment period, with unearned funds returned based upon when a student stops attending. These funds are returned to the military Service branch. When a Service member stops attending due to a military service obligation, the educational institution will work with the affected Service member to identify solutions that will not result in student debt for the returned portion.

A $500.00 International Sponsor Fee is assessed once per academic year. This fee is used to help cover the costs associated with all areas of processing/billing/monitoring/ advising/etc. of all internationally sponsored students. Designated staff members in both the Cashiers Office and the International Student Affairs Office are committed to ensuring all the student and sponsor needs and requirements are met. These additional services include additional billing after add/drop periods, individualized bills customized to the sponsor requests, and the ability for sponsored students to begin classes without prepayment in full based on your commitment to pay in full. Based on a commitment for payment in full, the sponsored students are also not subject to the assessment of finance charges and late fees on the agreed to amount that other students are assessed when the carry an unpaid balance. Any fees not covered by the sponsor are still billed and are the responsibility of the student. It is the student’s responsibility to provide the official Financial Guarantee or Letter of Credit from their sponsor prior to the first due date of each semester.

Tuition reimbursement is not the same thing as third-party sponsorship as discussed above in item 13. If a student is eligible for tuition reimbursement though their employer or other 3rd party it is still the student’s responsibility to pay their balance. Payments can be made either in full at the beginning of the semester or according to the semester payment schedule as you are invoiced each month. Students with tuition reimbursement are not exempt from the regular repayment schedule or the assessment of finance charges and late fees, or enrollment and transcript holds. Reimbursement programs are set up to directly repay the student what they have actually paid the University. Reimbursement programs do not typically cover finance charges, late fees, or other non-educational fees/expenses. The determination of what is and isn’t eligible for reimbursement is up to the organization. It is the student’s responsibility to confirm what is and isn’t covered.

Please remember that if the reimbursement program is dependent on final grades or completion of class, official and/or unofficial transcripts cannot be released to the student until the outstanding balance due is paid in full.

If you need documentation for tuition and fees paid for your reimbursement program you should reference either your monthly invoices in TouchNet or a paid fees letter in Pathway. You have access to an itemized summary of your charges and credits for each semester through the Pathway system. The paid fees letter will also show the classes and number of credits you are enrolled in. Log-in to the student Pathway system. Click the Financial Account tile, then “Paid Fees Letter”. From there you can select the term you desire information on and it will provide you with the Official Receipt/Paid Fees Letter. If the monthly billing statements and/or paid fees letter are not sufficient for your reimbursement program, please contact our office and we will do our best to accommodate your needs.

University policy requires that the current semester balance be paid in full prior to enrolling in a subsequent semester. The Cashiers Office may offer students who were unable to make their required monthly payments over the course of the semester an exception in the form of a past term repayment agreement. Repayment agreements are to be used as short-term assistance and are not a long-term financing option. Students requiring long-term financing for their debts should apply for loans with a traditional lender.

Excess federal financial aid from one semester will be automatically credited toward any balances from prior terms in the same financial aid year. All allowable prior term balances will be paid before any refund is issued to the student. Financial aid applied to a prior semester balance in the same academic year is not refundable. Any other loan, Veterans Affairs benefit or scholarship funds will be applied to any prior term balance unless specifically indicated for a certain semester by the issuer of that aid. Students who have initiated a repayment agreement are not exempt from aid applying to prior term balances.

Effective July 1, 2010, past term repayment agreements cannot exceed 12 months. The balance of the note must be paid in full within 12 months. However, existing repayment agreement and promissory notes will be honored according to the original terms.

Past term repayment agreement balances are still subject to monthly late fees and the 1% monthly finance charge.

The past term repayment agreement due date is always the tenth of the month. Our system does not recognize double payments or paying ahead. Payment must be made between the billing date and the due date showing on the statement to be current and avoid the late fee. If you decide to “prepay” before you are billed for the payment, your account will still be assessed the monthly late fee if another payment is not received before the actual due date for the payment.

Past term repayment agreements require monthly payments. Payments are expected to continue regardless of a student’s enrollment status.

Students under the age of 18 (such as in the High School Dual Credit Program) are required to have a parent or legal guardian sign as a responsible party to any past term repayment agreement.

Students with an active past term repayment agreement are still required to make any additional monthly payments that are required for the current semester. Additional debt for current semesters cannot be added to the existing past term repayment agreement.

Students making payments on a past term repayment agreement and a current term balance who paid online must contact the Cashiers Office immediately by email or phone so that payments can be directed to the appropriate balance. Payment can also be made in person and tell the cashier to direct to the appropriate balance. Online or mailed in payments will automatically be applied to the oldest term balance unless immediately notified to direct to a particular balance.

Financial aid disbursements are not considered as a past term repayment agreement monthly payment. Past term repayment agreement payments must be made each month until the balance is paid in full.

Students can always pay more than the minimum installment each month, but they must make the minimum payment each month to avoid the monthly late charge assessment.

Students are only eligible for one past term repayment agreement at a time. The balance of the previous or existing past term repayment agreement must be paid in full before a new one can be extended.

Oak Place Apartment balances (prior to the Spring 2012 semester) could not be included on past term repayment agreements. Beginning with the Spring 2012 semester Oak Place Apartment balances will be treated the same as traditional housing charges for the purpose of prior term repayment agreements.

A 25% down payment of past term balance is required to initiate the past term repayment agreement for students who intend on enrolling in an upcoming semester. The down payment cannot come from financial aid pending for a subsequent semester.

Former students no longer attending UMKC may begin a past term repayment agreement with no down payment. No transcript, diploma or certificate will be released until the balance is paid in full unless the student meets the exception requirements laid out in the Transcript Request Exceptions section.

Former students who have had a delinquent balance placed with a outside collection agency are not eligible for past term repayment agreements with the UMKC Cashiers Office. These students should contact the collection agency directly to make arrangements. For more information on outside collection agency placement see the Assignment of Debt to Professional Collection Agencies and Attorneys section.

Students may qualify for a lump sum past term repayment agreement. To qualify for a lump sum repayment agreement the student must provide documentation that they are able to pay the prior term balance in full by a specific date. The type of repayment agreement typically allow the student to coordinate the repayment of their prior term balance with the receipt of an anticipated aid refund from a future semester or a pending private loan from a bank. A lump sum agreement cannot be based on your financial aid refund per Federal Regulations. A 10% down payment is still required and finance charges and monthly late fees still apply.

The Cashiers Office reserves the right to administratively withdraw any student with a repayment agreement if either the down payment to start the agreement or a payment to bring the agreement current returns.

Short-term loans from the UMKC Financial Aid Office have their own repayment terms and cannot be included on a repayment agreement. The short-term loan balance and processing fee must be paid in full prior to starting a repayment agreement for a prior term balance.

Learn more about short-term loans (PDF)

Returned check balances cannot be included on a repayment agreement. Any returned check balance must be paid in full prior to starting a repayment agreement for a prior term balance

Past term repayment agreements cannot be extended or deferred. A missed payment will result in the past term repayment agreement being placed in a default status.

Students who have defaulted on a prior repayment agreement are not automatically eligible for future repayment agreements. If an exception is made/offered, the repayment agreement terms, including the down payment and length of the repayment term, are subject to change.

Financial aid disbursements are not considered a payment toward a past term repayment agreement. Past term repayment agreement payments must be made each month until the note balance is paid in full.

Students placed in default status that have not already been placed with outside collections will be given the opportunity to reinstate their past term repayment agreement by replacing all missed payments in a single lump sum payment. The payment cannot come from pending financial aid.

Students who have defaulted on their repayment agreement and have been referred to outside collections are required to pay the entire existing balance (including any charges not covered by the repayment agreement) in full before re-enrolling or obtaining a transcript.

The Cashiers Office reserves the right to administratively withdraw any student with a repayment agreement if either the down payment to start the agreement of a payment to bring the agreement current returns.

The university will pursue any and all collection efforts and practices including referring the account to a professional collection agency or attorney. The third-party collection agency may report balances assigned and payment history information to any or all national credit bureaus. The account will be assessed all additional collection charges associated with the collection of the debt including but not limited to collection agency fees, reasonable attorney's fees, court costs and all other charges allowed by law not to exceed 50% of the total charges.

Debt assigned to a collection agency or attorney is not eligible for a repayment agreement with the Cashiers Office. Once a debt is assigned to an outside agency the student must pay the balance in full, including any finance charges, late fees or collection fees, before they will be eligible to re-enroll or receive a transcript, certificate or diploma.

Students assigned to a collection agency need to make payments to that agency. Payments sent directly to the university will be applied to the account, and reported to the collection agency. Exceptions will be made for students paying with a third-party voucher.

Financial aid refunds are processed by the Cashiers Office. The receipt of a financial aid refund does not necessarily mean all prior term balances have been paid, or that all current semester charges have been applied to the account. Students are responsible for verifying the status of their current and prior semester charges.

Dropping or adding of classes at any point in the semester may result in additional charges or the reduction of aid, which would create student account balances. In addition, charges from the bookstore, Swinney Recreation Center, the Parking Office, the Student Wellness Center and the One Card Office are often posted to the student account after financial aid is disbursed. The student is responsible for paying these charges, even if the charge was initiated after financial aid was disbursed.

While the Cashiers Office cannot require the student to apply financial aid from a new aid year toward charges from a previous aid year, students with an unpaid past term balance may have their refunds sent directly to the Cashiers Office to cover the outstanding debt. UMKC is not responsible for any fees incurred by the delay in disbursement as long as the aid is still disbursed within federal guidelines.

Excess federal financial aid from one semester will be automatically credited toward any balances from prior terms in the same financial aid year. All allowable prior term balances will be paid before any refund is issued to the student. Financial aid applied to a prior semester balance in the same academic year is not refundable. Any other loan, VA benefit, or scholarship funds will be applied to any prior term balance unless specifically indicated for a certain semester by the issuer of that aid. Students who have initiated a repayment agreement are not exempt from aid applying to prior term balances.

Occasionally the Financial Aid and Scholarship Office makes adjustments to both current and previous semester terms financial aid award for a variety of reasons, including but not limited to, 1) total withdrawal from the University, 2) a student’s reduction in credit hours, 3) a student receiving aid at another University, and 4) a student losing eligibility for a particular type of aid. Any balance created by the adjustment of a financial aid award is due immediately and is subject to enrollment holds and transcript holds regardless of the invoiced due date.

The University may choose to write-off balances it deems uncollectable. However, students remain responsible to pay any balance, including late fees and finance charges, after a debt has been written-off. These balances must be paid in full to release transcripts, certificates, or diplomas. Students who want to repay their written-off balance need to contact the Cashiers Office to have the debt reinstated prior to paying. Once the written-off debt is reinstated it is subject to the resumption of finance charges and late fees.

The UMKC Cashiers Office reserves the right to resume collection activities on written-off balances. The only balances that students are not responsible for paying are those debts which have been legally discharged through bankruptcy filing and verified with the University of Missouri System General Counsel.

Students with charges added to the current semester after the last billing date of that semester, unpaid prior term balances, active bankruptcy filings or returned checks on their account are subject to an enrollment hold from the Cashiers Office. Enrollment holds may be placed on student accounts by other university offices as well.

The Cashiers Office will typically place enrollment holds on accounts after the third due date (March 20 and October 20) the last due date (April 20 and November 20) of every semester prior to open enrollment for the upcoming semester. Due to overlap in the enrollment period and the payment due dates or semester payment schedule, the final scheduled semester payment may not come due until after the enrollment hold is placed.

Students who have made their prior invoiced payments in full and on time may have the enrollment hold lifted. Students who manage to enroll without addressing their balance are subject to enrollment holds that will prevent drops and adds until the balance is addressed, they may also be dropped for classes.

The Cashiers Office may place enrollment holds on a student with an unpaid balance in default with another UM System campus (Columbia, Rolla or Saint Louis). The Cashiers Office would need to receive written notification from that campus that the balance has been satisfactorily resolved to remove that type of enrollment hold.

Occasionally, the Financial Aid and Scholarship Office makes adjustments to both current and previous semester terms financial aid award for a variety of reasons.

Any balance created by the adjustment of a financial aid award is due immediately and is subject to enrollment holds and transcript holds regardless of the invoiced due date.

Cashiers Office enrollment holds may be removed if the student does one of these actions.

The Cashiers Office is responsible for billing all university charges, including, but not limited to, tuition and fees, housing, meal plans, bookstore, recreation center, Roo Wellness and parking. The Cashiers Office is also responsible for collecting payments for these charges. The Cashiers Office does not waive, remove or forgive charges.

Students who wish to petition or appeal any balance may follow these instructions.

Learn more about appealing academic fees and charges

Academic fee petitions must be filed within 30 days of the end of the semester.

Learn more about appealing parking violations

Appeals for other account charges need to be directed to the university office that initiated the charge. The appeal is subject to that office’s policy and procedures.

Students with a balance under appeal are expected to continue making minimum payments toward their balance. Balances under appeal are still subject to late fees and finance charges during the petition process. Balances under appeal my also result in enrollment holds. Should a petition be granted any over-payment will be refunded and the associated late fees and finance charges waived.

Any personal check or e-check payment that is not honored by your bank will result in a $25 returned check fee. Any credit card payment that is later disputed with the credit card company is also subject to a $25 fee and the card transaction fee will be charged to the student account.

Checks or e-checks returned due to insufficient funds, closed account, account frozen, not authorized, stopped payment, disputed, etc. must be replaced with guaranteed funds of a credit card in the student's name, cashiers check or money order.

If the returned payment was made in an attempt to enroll in current or upcoming semester classes, your classes may be subject to cancellation. If the returned payment resulted in the release of transcript or diploma, the documents must be returned to the university until the balance is paid in full.

The university will pursue all options in collecting on returned payments including assignment to outside collection agency, legal prosecution with the Jackson County (Missouri) District Attorney’s Office and referral to UM System legal counsel to initiate other legal proceedings. Once students are assigned for bad check prosecution or other legal proceedings they are not eligible for any alternative arrangements with the Cashiers Office.

The Cashiers Office reserves the right to administratively withdraw any student with a repayment agreement if either the down payment to start the agreement or a payment to bring the agreement current returns.

Returned check balances must be paid in full to remove enrollment holds and must be paid in full prior to starting a repayment agreement. Certain types of aid may be automatically applied to a returned check balance when it is disbursed; however, anticipated aid is not sufficient to resolve any hold preventing enrollment, transcript release or charging privileges.

The ability to submit check or e-check transactions can be suspended permanently if multiple returns have occurred.

The ability to submit card payments can be suspended permanently if a card payment is disputed.

Students who submit any type of electronic payment that is stopped, returned or disputed are subject to having all electronic payment options suspended or permanently stopped.

Students are also responsible for replacing any payment submitted by a third party on their account that is returned for any reason.

Minors attending any UMKC class, whether on campus or online or through their high school or any other satellite classroom, are required to have consent from a parent or legal guardian. That parent or legal guardian must also accept financial responsibility for any and all balances that the minor student may incur.

Both the University of Missouri’s Statement of Financial Responsibility (PDF) and High School College Program Application for Admission, which includes a provision for parental permission and financial responsibility, must be signed at time of enrollment. Students who enroll without signing and returning the require documents will be dropped from classes and will not be eligible for credit or re-enrollment until the documents are returned.

In the Spring and Fall semesters the Cashiers Office, in conjunction with the Office of the Registrar, will drop students for nonpayment. Students who have not paid 25% of their semester balance by the first due date of the semester will be at risk of being dropped before that semester’s census date.

Students who anticipate using financial aid to pay their balances need to accept their aid and verify that it disburses prior to the drop date. Students whose aid award or disbursement is delayed for any reason are still responsible for either making the 25% payment or having a hold put on their enrollment by the Financial Aid and Scholarships Office.

Students at risk of being dropped will be sent an email notification to their UMKC email address, and the Cashiers Office will attempt to contact the student by phone as well. The drop notification email contains specific information on the process to avoid being dropped and how to get re-enrolled if they are dropped.

It is the students’ responsibility to follow the Registration and Records Office established semester refund schedule for other types of withdrawals.

If a student is dropped for nonpayment the student is still responsible for 100% of any charges with the Bookstore, Parking, One Card, Clinic, Pharmacy, short-term loan or any other office on campus.

The Cashiers Office reserves the right to administratively withdraw any student with a repayment agreement if either the down payment to start the agreement or a payment to bring the agreement current returns.

The Cashiers Office reserves the right to administratively withdraw any student with an unpaid balance in default with another UM System campus (Columbia, Rolla, or Saint Louis).

The Soldiers and Sailors Civil Relief Act provides protections for armed forces service members called to active duty during wartime. The protections include a limit on finance charges that can be applied to any unpaid debt. This limit of finance charges specifically does not apply to federal student loans.

In order to ensure compliance with this act, the Cashiers Office will suspend the monthly finance charge and late fee applied to any accounts receivable balance for any current or former student called to active duty, provided they did not incur the debt while already on active duty. Monthly invoices will continue to be sent to the address on file with the Cashiers Office, but the assessment of finance charges and late fees will stop during the duration of the active duty assignment.

Any current or former student with an outstanding balance who is called to active duty can request the stay on finance charges and late fees by completing an SSCRA form (PDF) and submitting it to the UMKC Cashiers Office along with a copy of their active duty orders. The form and copy of active duty orders need to be provided to the UMKC Cashiers and Collection Office as soon as possible, but within 90 days of the active duty start date. The documents can be delivered in person to our office, emailed to cashiers@umkc.edu, or mailed to our payment address.

UMKC takes fraud and identity theft seriously and investigates claims in a timely fashion. As soon as you become aware of an issue, you may report a claim, which will be reviewed by the UMKC Fraud and Identity Theft Committee. You may expect a written response to your claim within six weeks.

Since March 2014 UMKC has participated in the Missouri Department of Revenue Debt Offset Program. Any balances deemed uncollectable or referred to an outside collection agency are eligible to be referred to the State Department of Revenue in an attempt to intercept any state income tax return funds that could be applied to an unpaid debt.

The university will seize any funds available, regardless of your repayment status or pending agreement with an outside collection agency. If your state income tax return is intercepted you will receive a mailed notice, and be given 30 days to file an appeal. If you wish to contest the tax offset and want to request a refund of the intercepted funds, you must submit your request in writing.

It is important that you include your UMKC ID or Social Security Number in your written request. All requests will receive a response by U.S. mail.

If your appeal is granted or partially granted, a refund will be issued within five business days of the university receiving the funds from the Missouri Department of Revenue. It typically takes 30–45 days from the date of offset for the tax offset funds to be received from the state. Unless otherwise stated any granted appeal with a refund issued should not be considered a waiver or discharge of the debt.

All requests will initially be reviewed by the Cashiers Office for any errors. Any specific charge that is disputed will be reviewed with the appropriate originating office and will be verified or corrected as necessary.

If an appeal is initially denied, your response will have an explanation of the debt and documentation of the debt. When applicable, though a tax offset appeal may be initially denied, the debtor may be referred to the appropriate existing standard university process to appeal or petition their debt. If after receiving your denial letter and reviewing the documentation provided you still dispute the debt and want to provide evidence that supports your dispute you may request a formal meeting to present your evidence to the Tax Offset Committee. However, you must first exhaust all existing standard appeals processes including but not limited to: parking ticket appeal, tuition and fee appeals, retroactive withdrawal petitions or residency status appeals.